Gold is up 54% year to date in November, 2025 providing one of the strongest returns for the yellow metal in the past decade. We think an investment in the metal still makes sense due to:

Uncertainty on inflation given tariffs and AI capex spending.

Large U.S. government debt of $38 trillion, 124% of GDP vs. 68% of GDP in 2008.

Political uncertainty, particularly U.S. freezing $300 Billion of Russian assets from the Ukraine war which continues, Middle East turmoil and concern on potential aggression from China towards Taiwan.

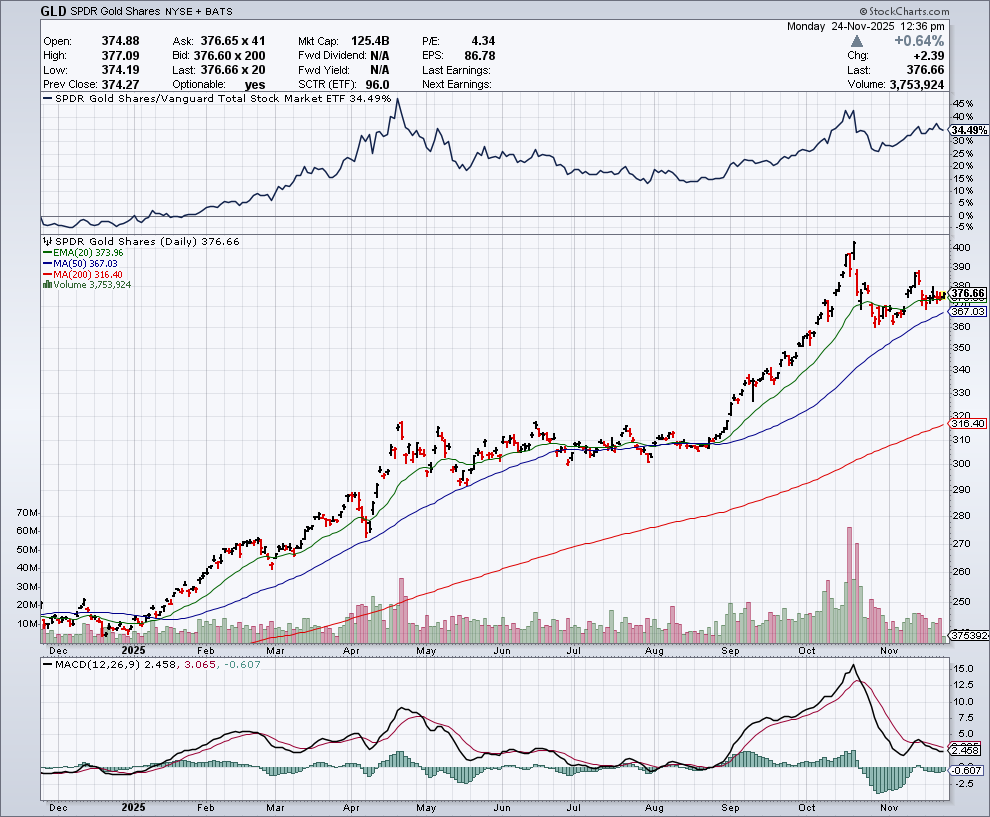

We view the GLD ETF as an easy efficient way to have a

Support are bullish thesis are the following facts:

Central bank purchases at all time high in 2025 at 1,000 metric tons per year.

Gold production globally flat for several years at 3,000 metric tons per year.

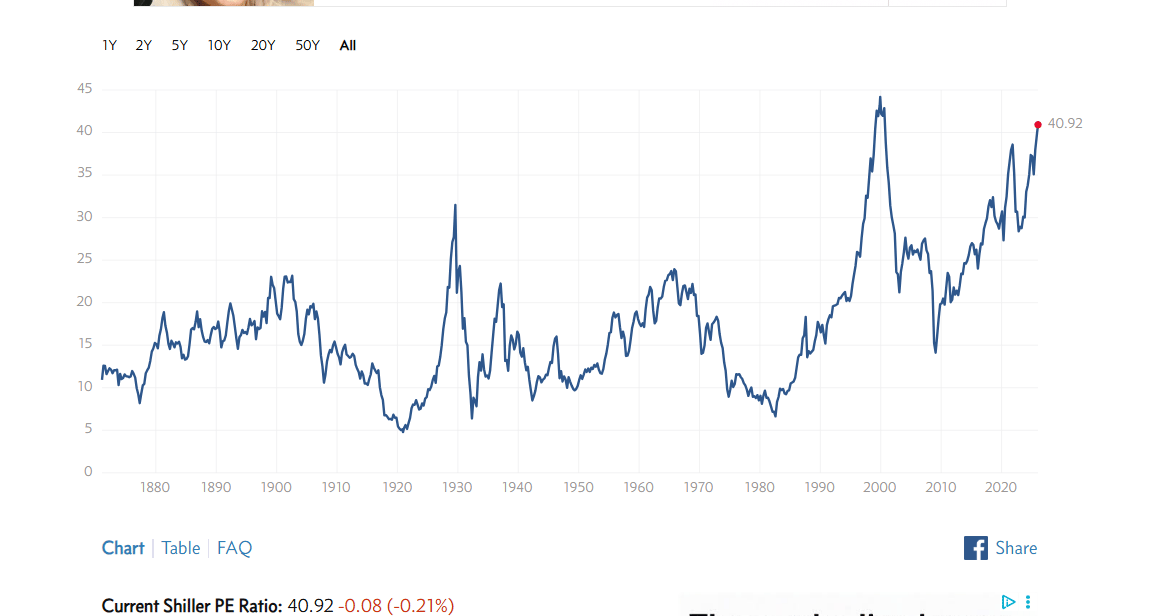

Gold has risen 54% in 2025 as a safety haven while Bitcoin (digital gold) face a significant collapse recently and stocks have risen for several years to high valuations as measured by Case Shiller PE, dividend yield and other metrics.

Case Shiller PE currently sits at 40, near peak levels of 1999. S&P 500 returned +26.2% in 2023, _24.8% in 2024, and is up over 17% year to date as of November in 2025. Although calling the top in equities and the S&P is impossible, it’s logical that having a 5%-10% allocation to gold can help protect any upcoming equity volatility.

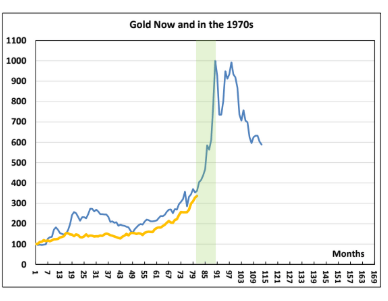

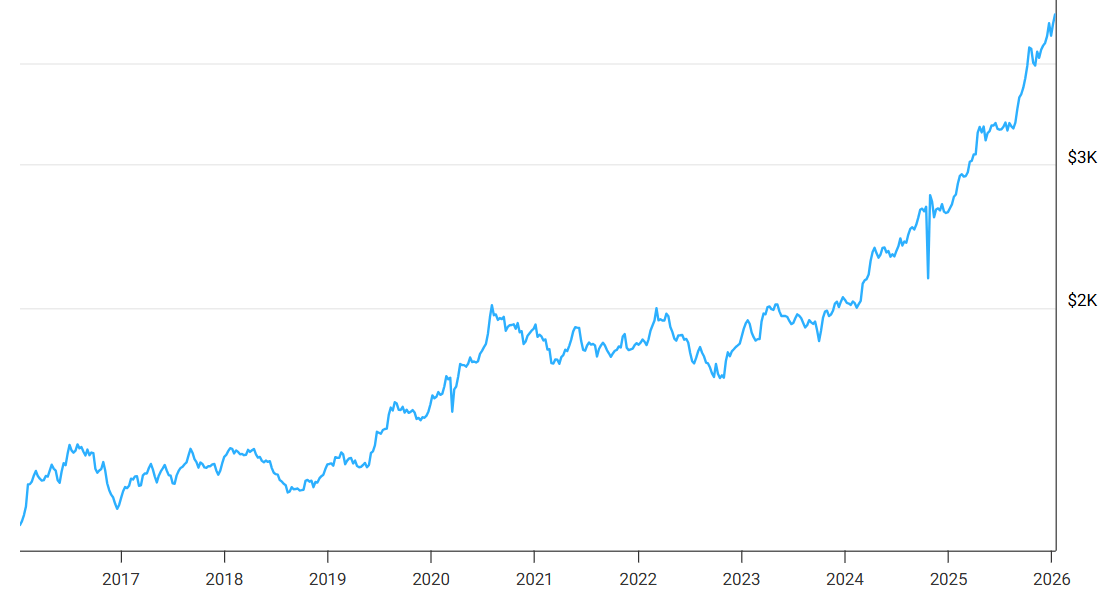

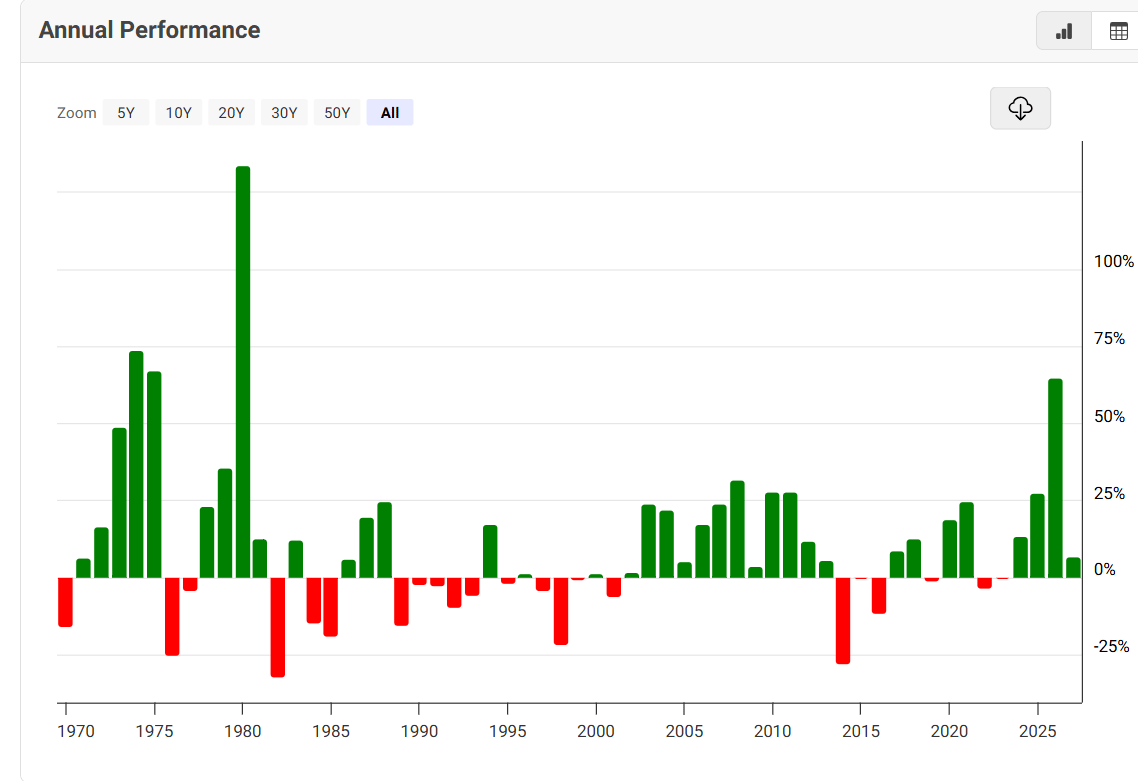

Gold by contrast was up 12.6% in 2023, 26.7% in 2024 and is up +54% in 2025 mid November to 54% to $4,000 (up from $2,600 in January 2025). Although this is a steep rise, indexing the recent gold movement to it’s rally in 1977 to 1980 would indicate gold can easily rally to $5,000, $6,000 or potentially $7,000 in 2026.

Blue is the Gold rally 1971 to 1980, Gold went from $38 to $ 850 (2,300%), Yellow is current Gold rally which started approximately which started approximately March of 2024 at $2,100 (vs current $4,000) price.

Although the recent run up in gold price is impressive as shown below, the second chart shows annual performance which given the drivers for the current run look set to continue into 2026.

We conclude that both JPM and UBS have year end target of $5,000 for gold 2026 which is in line with the consensus sell side view. However we note that the sell side consensus year end 2025 gold target was $3,000 at the start of 2025 and the gold price closed above $4,000.

An allocation to gold makes sense given that all the conditions that caused it to rise in 2025 are still in place and history from the 1970’s shows another large move in 2026 is likely.