👉 MAJOR ECONOMIC NEWS THIS PAST WEEK - sticky inflation, poor consumer sentiment, sluggish manufacturing. |

|---|

Personal Consumption (PCE), Michigan Consumer Sentiment, ISM Manufacturing |

Monday (12/1): ISM manufacturing, S&P final U.S. manufacturing PMI |

Tuesday (12/2): Auto sales |

Wednesday (12/3): ADP employment, Import price index (delayed report), Import price index minus fuel, ISM services, S&P final U.S. services PMI |

Thursday (12/4): Initial jobless claims, U.S. trade deficit |

Friday (12/5): Consumer credit, Consumer sentiment (prelim), Core PCE (year-over-year), Core PCE index (delayed report), PCE (year-over-year), PCE index (delayed report), Personal income (delayed report), Personal spending (delayed report) |

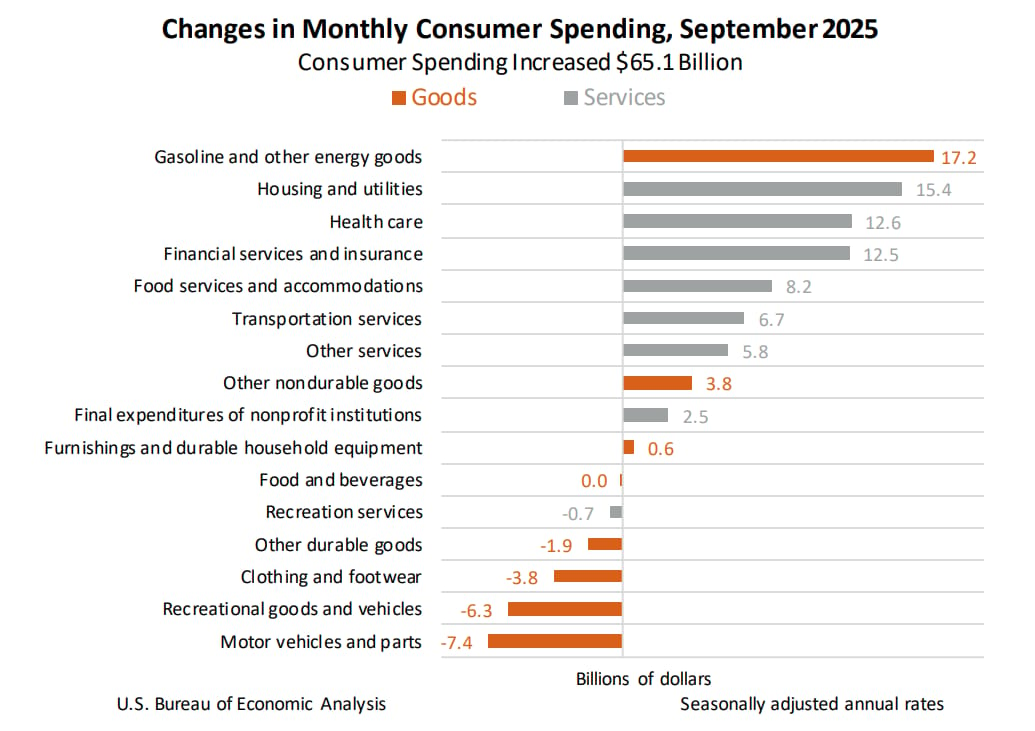

What the Latest PCE Data Shows (Sept 2025): |

|---|

Core PCE (Excluding Food & Energy): Rose 0.2% month-over-month (MoM) and was up 2.8% year-over-year (YoY), slightly down from August's 2.9%.

Headline PCE: Increased 0.3% MoM and was up 2.8% YoY, slightly faster than August.

Consumer Spending: Rose 0.3% MoM but slowed from the prior month, with spending on services rising modestly.

Personal Income: Grew by a solid 0.4% MoM.

Key Takeaways & Commentary:

Fed's Inflation Gauge: The PCE index captures broad consumer spending, making it vital for the Federal Reserve's monetary policy decisions.

Inflation Still Sticky: While the core PCE eased slightly, both figures remain above the Fed's 2% goal, suggesting inflation pressures persist.

Rate Cut Debate: The mixed data fuels debate on a December Fed rate cut; some see moderate inflation and a cooling labor market as supporting cuts, while others worry about underlying price pressures.

Delayed Data Impact: The release was delayed due to a government shutdown, with this September data being the latest available ahead of the Fed's next meeting.

In essence, the commentary highlights that while inflation isn't accelerating wildly, it's proving stubborn, complicating the Fed's path forward on interest rates, even as consumer spending shows signs of moderating under higher prices.

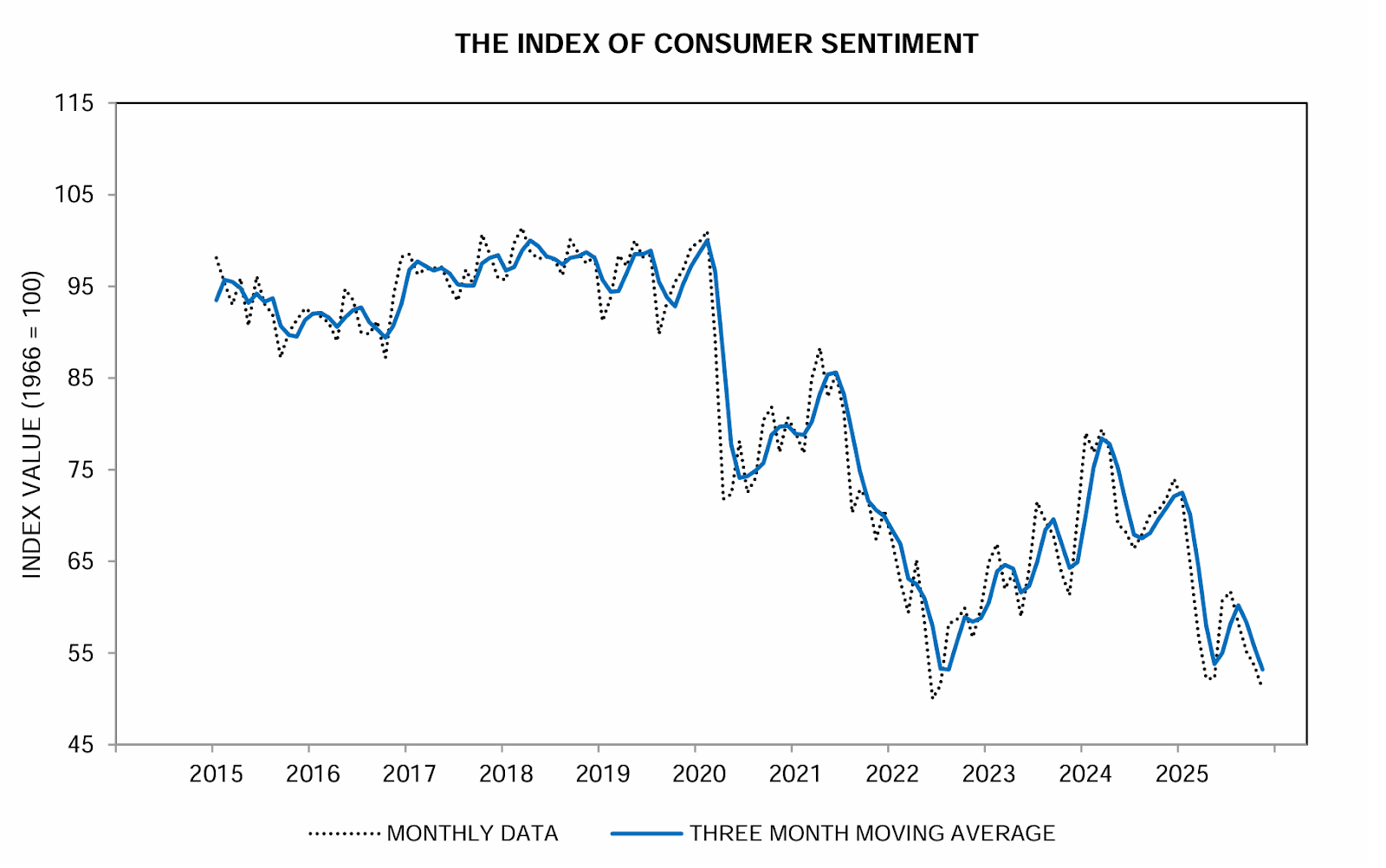

“Consumers saw little meaningful change in economic conditions this month – high prices and weakening incomes remain at the forefront of their concerns.” |

Michigan Consumer Sentiment

The University of Michigan Consumer Sentiment Index rose slightly to 51.0 in November (from a preliminary 50.3) following the end of the federal shutdown, but the improvement leaves sentiment hovering near historic lows — the second-weakest reading on record. |

The Current Conditions Index fell 12.8% to an all-time low of 51.1, reflecting steep declines in personal-finance assessments and major-purchase conditions. |

Inflation expectations continued to ease: 1-year expectations dipped to 4.5% (from 4.6%), while 5-year expectations softened to 3.4% (from 3.9%). Late-month equity volatility also weighed on wealthier households, with sentiment among top-stock-owning consumers slipping roughly 2 points from October. |

Consumer Sentiment (Final): 51.0 vs. 50.3 preliminary

Current Conditions Index: 51.1 vs. 58.6 prior

1-Year Inflation Expectations: 4.5% vs. 4.6% prior

5-Year Inflation Expectations: 3.4% vs. 3.9% prior

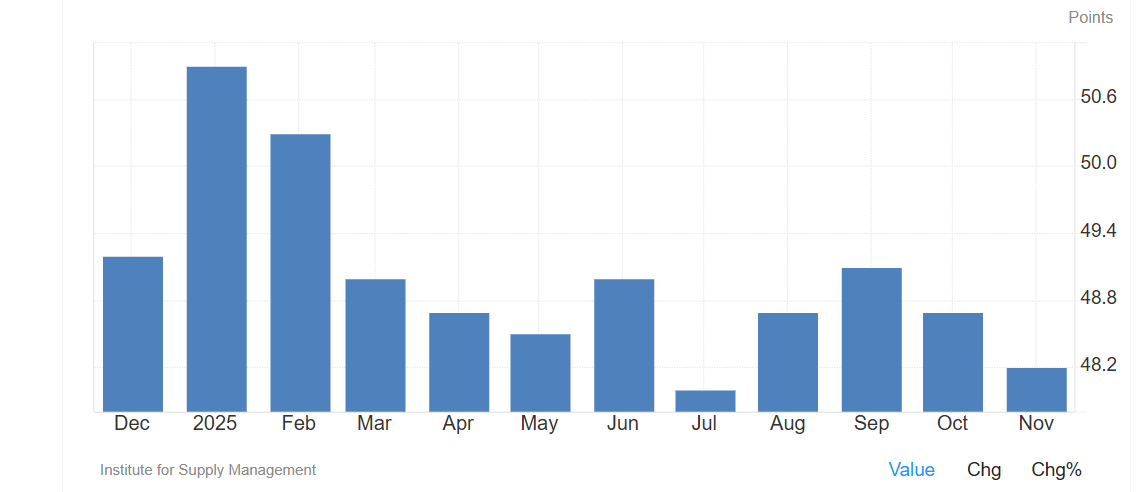

3. ISM Manufacturing |

The ISM Manufacturing Report for November 2025 showed continued contraction in the U.S. manufacturing sector, with the PMI dropping to 48.2 (below 50 indicates contraction), marking the ninth straight month of decline and a faster contraction pace than the prior month. Key areas like New Orders and Employment worsened, while Prices Paid rose, signaling weak demand but increasing cost pressures, leading to a mix of contraction and inflation worries. Key Takeaways from the November 2025 Report (Released December 1st, 2025): |

Manufacturing PMI: Fell to 48.2 (from 48.7 in October), indicating deeper contraction.

New Orders: Contracted at a faster pace (47.4).

Employment: Declined (44.0), with more workforce reductions.

Prices Paid: Increased (58.5), suggesting rising input costs.

Production: Rebounded slightly into expansion (51.4).

Backlog of Orders: Continued to shrink (44.0), pointing to ongoing demand weakness.

“Consumers saw little meaningful change in economic conditions this month – high prices and weakening incomes remain at the forefront of their concerns.” |